A review of EADB’s Rural Finance Enhancement Programme

A review of EADB’s Rural Finance Enhancement Programme

As the first round of EADB’s Rural Finance Enhancement Programme (RFEP) comes to a close, it seems a sensible time to provide an overview of the project, considering it’s importance to Uganda, the lessons learnt from the first round and how we will proceed with the programme in 2017.

Agriculture in Uganda

84 per cent of Uganda’s population lives in rural areas and 72 per cent of the population is employed in agriculture. However, the agricultural sector’s contribution to economic activity stands at only 26 per cent due to the fact that most agricultural activity is subsistence based. Furthermore, Uganda’s high population growth, combined with early evidence of climate change amidst absent insurance mechanisms, has caused the productivity of the agricultural sector to fall.

The vulnerability of Uganda’s agricultural sector with respect to climate change is particularly evident in the coffee industry. Coffee is Uganda’s dominant export crop, but is principally grown by smallholder farmers. However, prolonged drought and unpredictable rainfall, both consequences of climate change, are increasingly affecting coffee yields. In 2010, unprecedented flooding in Eastern Uganda destroyed 60,000 coffee trees. More recently, rising temperatures have seen coffee leaf rust, a fungus previously found at low altitudes, spreading to higher altitudes, where plants used to be safe from disease. In 2016, Ugandan coffee exports fell to 15 per cent, their lowest ever recorded contribution to the total export bundle.

The largest hindrances to agriculture in Uganda include the high cost and limited availability of inputs, weak infrastructure, a lack of market information and inadequate post-harvest facilities. In addition to the above, private sector credit growth to agriculture has slowed from 16 per cent in 2015 to just 9 per cent in 2016, which cements the importance of the Rural Finance Enhancement Programme.

The Rural Finance Enhancement Programme

The Rural Finance Enhancement Programme (RFEP) intends to improve access to customised and sustainable agricultural financial services for small- and medium- sized enterprises (SMEs) in Uganda. The programme operates throughout the agricultural value supply chain, from input providers to farmers to agricultural traders and buyers, to promote agricultural investment and to provide a sustainable income to the rural community, which should ultimately assist poverty reduction and food security.

Under an €8 million loan from KfW, EADB has engaged three partner financial institutions (PFIs) to on-lend the funds to SMEs in rural Uganda. By January 2016 all three PFIs had been identified, allocated financing and challenged to disburse all of their funds by end December 2016.

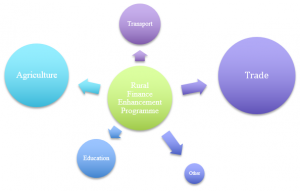

By the end of December 2016, of all the loans disbursed to rural SMEs, 28 per cent had been disbursed to agriculture (including production, marketing and animal breeding), 34 per cent to trade (mainly imports and distribution), 18 per cent to transport and 17 per cent to education. Furthermore, the average loan tenor was above the industry average at 3 years, whilst the average lending interest rate was below the industry average at 23.4 per cent.

Figure 1: Sectoral loan distribution of the RFEP

Lessons learnt

The PFIs that EADB engaged range from commercial banks that are used to serving micro enterprises to commercial banks that typically serve large corporates. This approach has a distinct advantage in that the loans offered to rural SMEs will offer a variety of upscaled microfinance elements and downscaled corporate elements, thereby also creating some degree of market competition in SME financing.

Figure 2: Creating market competition for SME financing

The first round of the Rural Finance Enhancement Programme has had success stories: one partner financial institution very quickly deployed all of its allocated funding and reported demand for further financing.

However, there have also been difficulties in that two partner financial institutions did not fully understand the context of the project and so failed to fully utilise their allocated funds by the close of the year. The programme encountered difficulties in 2016 owing to drought, neighbouring civil war (which reduced demand for agricultural activity and exports) and in some cases a need for capacity building from the PFIs.

There is little that can be done to mitigate the effects of drought and civil war in neighbouring countries, but EADB can assist in developing appropriate technical capacity amongst the PFIs looking forward.

Looking forward

The first round of the Rural Finance Enhancement Programme has been extended until end June 2017, but we are confident that it will be a success.

Furthermore, we believe that the model is a successful model in that it builds market competition and technical capacity of financial institutions in a largely neglected sector. Despite the necessary extension of the first round of the programme, we are confident in its success and sustainable development outreach and are planning two similar programmes in 2017.